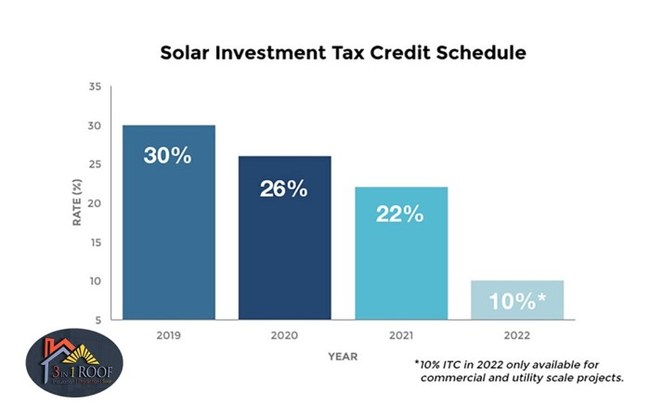

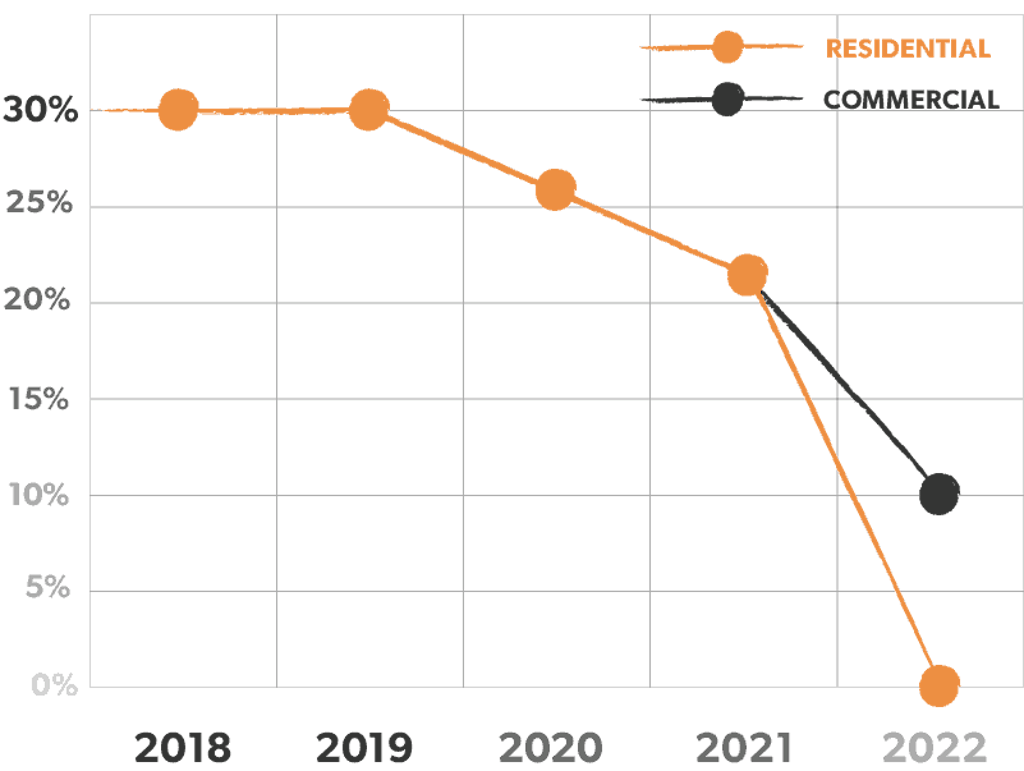

As modified 48 phases down the itc for solar energy property the construction of which begins after december 31 2019 and before january 1 2022 and further limits the amount of the.

Federal solar investment tax credit irs.

Your federal tax credit.

To claim a general business credit you will first have to get the forms you need to claim your current year business credits.

Solar industry has grown by more than 10 000 creating hundreds of thousands of jobs and investing billions of dollars in the u s.

For example if your solar pv system was installed before december 31 2019 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows.

P title iii 303 129 stat.

The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

These instructions like the 2018 form 5695 rev.

The itc applies to both residential and commercial systems and there is no cap on its value.

The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.

Since the itc was enacted in 2006 the u s.

In addition to the credit form in most cases you may also need to file form 3800.

The residential energy credits are.

Individual income tax transmittal for an irs e file return page last reviewed or updated.

About form 4255 recapture of investment credit about form 8453 u s.

0 3 18 000 5 400 state tax credit.

If you file a form 1040 or 1040 sr schedule c you may be eligible to claim the earned income tax credit eitc.

Use these revised instructions with the 2018 form 5695 rev.

Economy in the.

2242 extended and modified the investment tax credit itc under 48 of the internal revenue code code.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.