The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic pv system 2 other types of renewable energy are also.

Federal income tax credit solar panels.

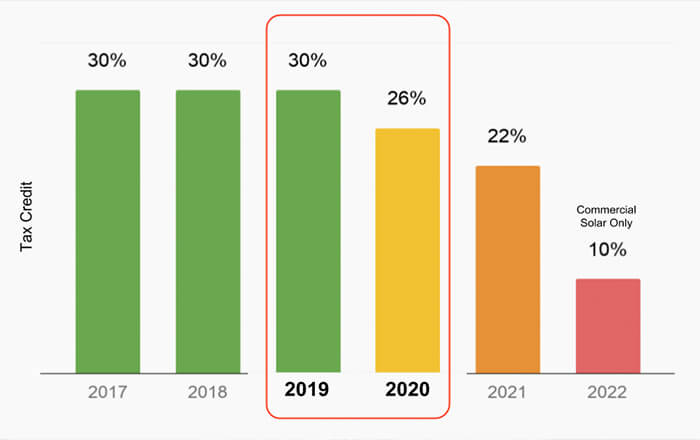

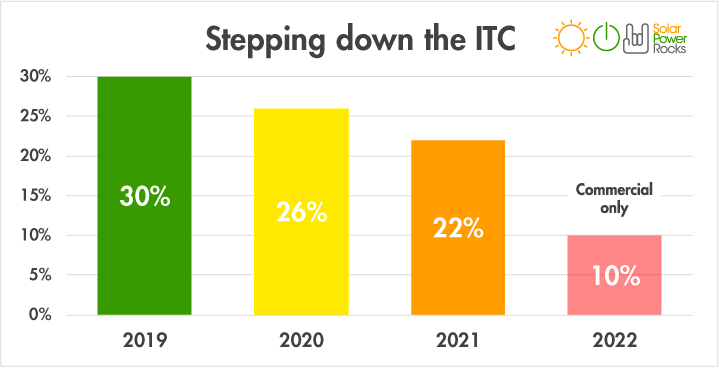

If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation.

What is the federal solar tax credit.

The federal solar tax credit allows you to deduct up to 30 of the cost of installing solar energy systems in homes and industries in the u s.

If you have a 1 credit you pay 1 less in taxes.

Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 what is the federal solar tax credit.

To claim the credit you must file irs form 5695 as part of your tax return.

The solar investment tax credit itc is a tax credit that can be claimed on federal corporate income taxes for 30 of the cost of a solar photovoltaic pv system that is placed in service during the tax year 1 other types of renewable energy are also eligible for the itc but are beyond the scope of this guidance.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

If you spend 10 000 on your system you owe 2 600 less in taxes the following year.

Filing requirements for solar credits.

There is no cap to the value of the system installed and this deduction applies to both residential and commercial solar system installations.

You calculate the credit on the form and then enter the result on your 1040.

The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

When you install a solar system 26 of your total project costs including equipment permitting and installation can be claimed as a credit on your federal tax return.

It s as simple as that.

The december 18 bill contained a 5 year solar tax credit extension which makes solar energy more affordable for all americans.

The solar tax credit is a tax reduction on a dollar for dollar basis.

The solar tax credit expires in 2022.